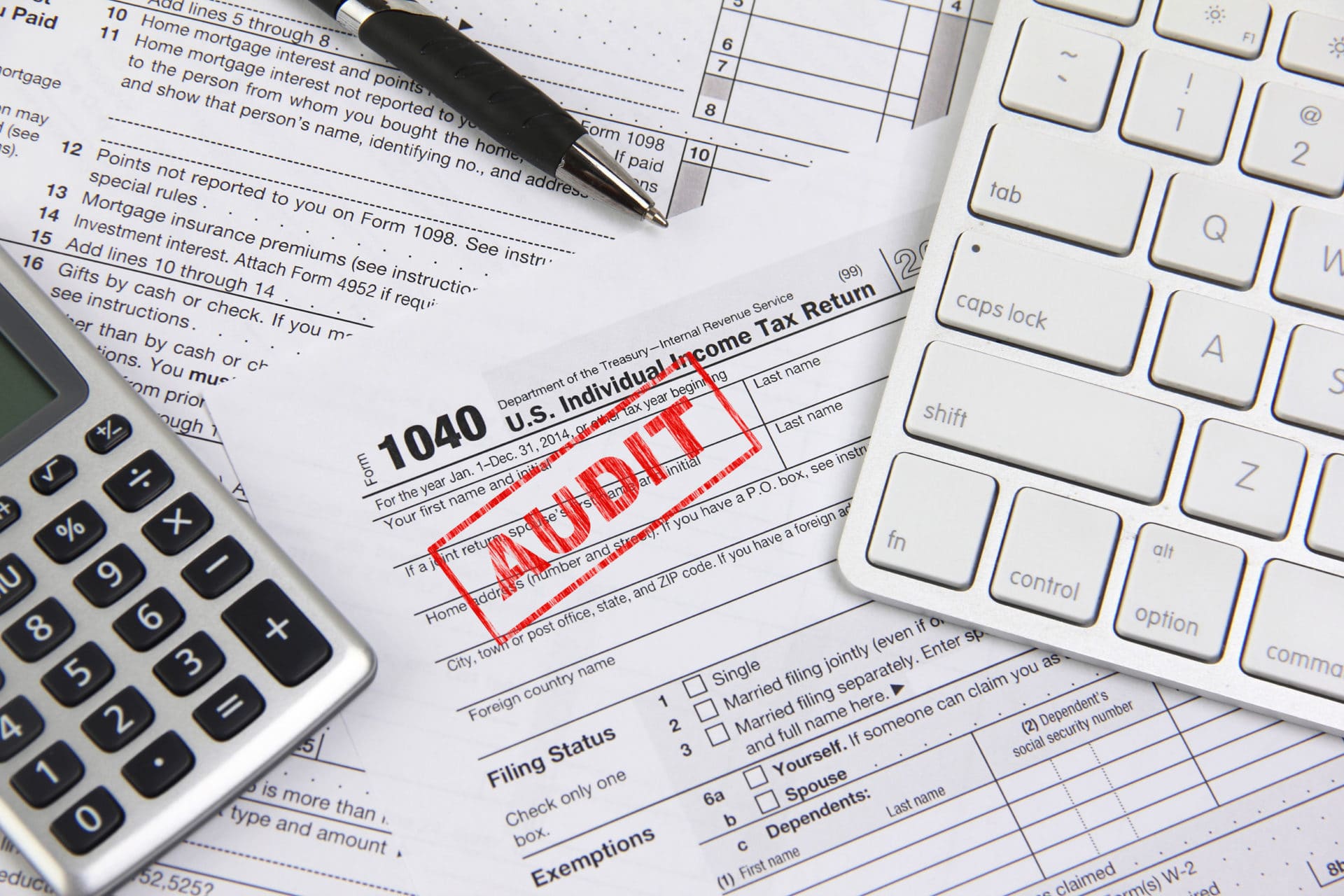

Tax Time Is Almost Here – Could You Accidentally Commit Fraud in IL?

Everyone dreads tax time. Even if you’re owed a nice rebate, the hassle of preparing your income tax returns is a headache, and most of us put it off until the last minute. However, if you’re not careful when preparing your tax returns, you could face something far more serious than missing a portion of your refund: income tax fraud charges. Individual slip-ups typically fall into the category of negligence rather than fraud, but even seemingly harmless white lies can potentially be considered tax fraud. Let’s take a look at how the law defines income tax fraud, and how to avoid inadvertently committing it.

Income Tax Fraud Defined

Income tax fraud is defined as a willful attempt to evade tax law or defraud the IRS. Tax fraud occurs when an individual, corporation, or other entity does any of the following:

- Purposely fails to file an income tax return

- Intentionally fails to pay taxes due

- Willfully fails to report income

- Makes a false or fraudulent claim

- Prepares and files a false tax return

Common Tax Mistakes People in Illinois Make

Common tax mistakes include:

- Filing a tax return with incorrect or missing information

- Incorrectly claiming earned income tax credit when you’re not eligible for it. This is a common IRS audit trigger

- Abusing tax shelters, which are often proposed by accountants and wealth planners

- Claiming improper or inflated deductions

- Failure to report income

- Falling victim to tax preparer fraud, in which a tax preparer claims credits or deductions that you’re not entitled to in order to increase their own fee

In short, if you don’t pay close attention while preparing your tax returns this tax season, you might end up inadvertently committing tax fraud or negligence. There’s a big difference between those two things, though, and it’s important to understand.

Tax Fraud… or Tax Negligence?

So, you’ve made a mistake on your taxes. But does it constitute fraud, or is it an honest mistake?

By definition, fraud must be committed willfully, and with the intent to defraud the victim – in this case the IRS. Tax mistakes committed inadvertently are considered negligence.

The IRS understands that tax code is complex, and is difficult for most people to decipher. Therefore, IRS auditors look for common signs of fraudulent activity, including:

- Overstatement of exemptions and deductions

- Falsified documents

- Transfer or concealment of income

- Maintaining two sets of financial ledgers

- Falsifying personal expenses as business expenses

- Willfully underreporting income

- Using a false Social Security number

- Claiming exemptions for nonexistent dependents

- Forgery of documents

Consequences of an Income Tax Fraud Violation

If you’re audited and found to have committed negligence, you’ll be required to pay whatever amount you have underpaid to the IRS, and potentially a penalty of 20 percent of the underpayment.

If you’re found to have intentionally committed tax fraud, you will also be subject to criminal consequences, including:

- Attempt to evade or defeat paying taxes: This is a felony punishable by up to five years of imprisonment and/or a fine up to $250,000, plus the cost of prosecution.

- Fraud and false statements: If you falsified documents, you’ll be charged with a felony punishable by up to three years of imprisonment and/or a fine of up to $250,000, plus the cost of prosecution.

- Willful failure to file a return, supply information, or pay tax at the time required by law: This is a misdemeanor, and is punishable by up to one year of imprisonment and/or a fine of up to $100,000, plus the cost of prosecution

To avoid making a tax mistake, exercise the utmost caution when preparing your returns this year. And if you run into income tax problems, get help sooner rather than later to learn more about your options and avoid greater consequences.

About the Author:

Andrew M. Weisberg is a former felony prosecutor who now serves as a defense attorney in the greater Chicago area. He has extensive experience in handling all types of criminal cases, from sex offenses and domestic violence to retail theft-related crimes, murder, and drug crimes.

Blog Home

Blog Home